A non-workman earning up to 2600. Working on Off-day 20 Basic pay 26 days X 20 X hour of works.

Your Step By Step Correct Guide To Calculating Overtime Pay

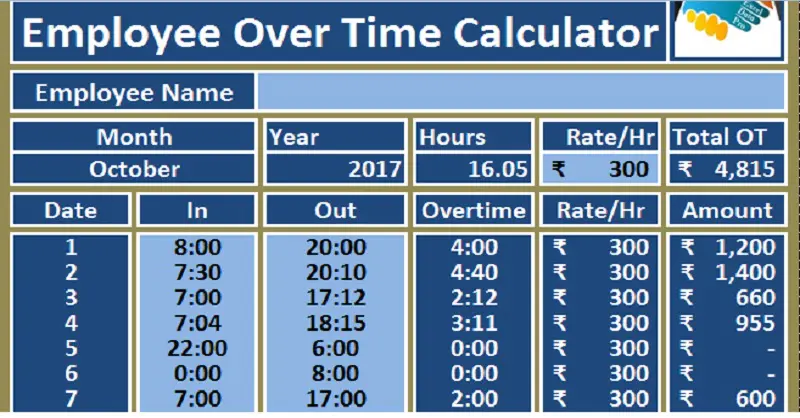

Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate.

. In Malaysia the Employment Act 1955 defines overtime as the number of hours of work done beyond the normal working hours daily. If the job due to its nature requires working overtime the payment will be the equivalent of the salary paid in normal working hours plus a surcharge of not less than 25 of the salary. An employee monthly rate of pay is always fixed to 26.

For employees paid on a monthly basis overtime entitlements under the Employment Act are as follows. Basic Allowance Incentive 26 days 8 hours. Depending of your business goals check if your staff is clocking in too much overtime hours.

800 40 20 an hour. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. In addition to the PH pay employees get OT of 2 times the ORP for one day.

How to Perform Salary Calculator Malaysia. How to calculate your salary per day malaysia. Working on Public Holiday.

RM 6000 RM 2500 RM 8500. Because of this you will multiply the regular hourly rate by 05 instead of 15 to get the overtime hourly rate. Calculate the overtime hourly rate.

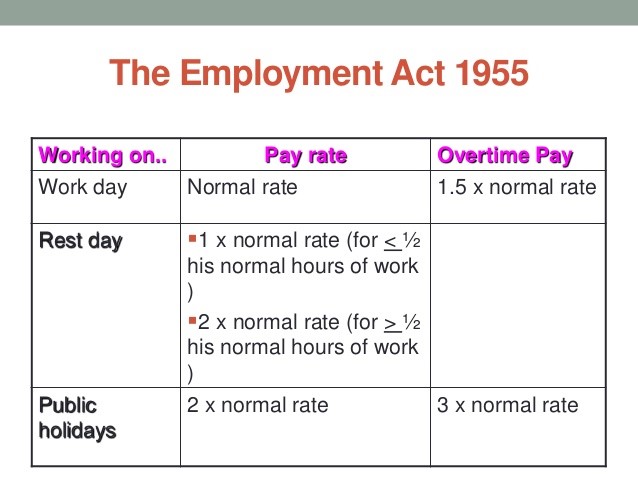

More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii. The Employment Act provides that the minimum daily rate of pay for overtime calculations should be. Daily salary 8 hourly salary.

This is applicable for employee overtime pay in Malaysia regardless of the salary being calculated by daily rate or monthly basis. Where work does not exceed half his normal hours of work. More than half but up to eight 8 hours of work-10 x ordinary rate of pay one days pay iii.

A workman earning up to 4500. For holiday you should pay employee at rate 20 X for the first 8 working hours. And similar to salary and other mandatory benefits overtime pay.

RM 5500 x 11 refer Third Schedule. This is applicable for employee overtime pay in Malaysia regardless of the salary being calculated by daily rate or monthly basis. 15x hourly rate of pay.

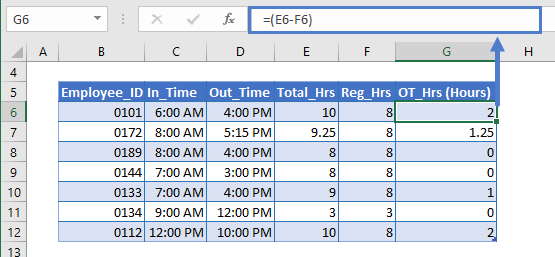

Total pay 950. One way to do it is to divide their weekly pay by the number of hours they work in a week. Employee work 10 hours on rest day.

The Employment Limitation of Overtime Work Regulations 1980 grants that the limit of overtime work shall be a total of 104 hours in any 1 month. Salary Formula as follows. Gross salary X 12365 daily salary.

As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. It is applicable to shift employees where they work for a specific period of time. Normal working day 15 Basic pay 26 days X 15 X hour of works.

However employers are also allowed to choose any other calculation basis which is more favourable to the employee eg monthly wages22 if the employee works 5 days a week. Code 23143a1 7. Of course overtime work has a limit.

For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. In excess of eight 8 hours-20 x hourly rate x number of hours in excess of 8 hours. 10 x 05 5 more per overtime hour.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. First calculate the daily ordinary rate of pay by dividing the monthly salary by 26. 5 OT hours x 20 an hour x 15 150 OT pay.

Basic pay 26 days X 30 X hour of works. RM1200 per month 26 days RM577 per hour X 2 RM5769 per day. This is applicable whether the employees are paid on a daily rate or on a monthly basis.

For instance lets say they make 800 a week and work 40 hours per week. General Nutrition Ctrs Inc 220 A3d 1038 1051-59 Pa. Then they worked 5 overtime hours.

An employee weekly rate of pay is 6. Where work does not exceed half his normal hours of work. This means an average of 4 hours in 1 day.

You can claim overtime if you are. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. Overtime work is all work in excess of your normal hours of work excluding breaks.

Rest day follow normal working hours. Working in excess of normal working hours on a normal work day. Employees with a monthly Employee Subgroup should have their Time Management Status set to Time.

Even though the pay rate is 1 ½ time the hourly rate of employee pay some employers found it rather economical to. Calculation of overtime on Public holiday PH which is recognised by employer. Rm50 8 hours rm625.

Notably the Pennsylvania Department of Labor and Industry stated that the new rule only applies to the calculation of overtime for salaried nonexempt employees and declined to clarify how its rulemaking may. Career Resources - Overtime is part of work life. Then divide the ordinary rate by the number of normal work.

61 Overtime calculation in the UAE. Working hours permitted under akta kerja 1955. ½ the ordinary rate of pay for work done on.

RM 8500 x 12 refer Third Schedule. RM 5500x 12 calculation by percentage. Salaries in malaysia range from 1670 myr per month minimum salary to 29400 myr per month maximum average salary actual maximum is higher.

You have already accounted for the overtime hours once in the regular hourly rate. Daily ratemonthly salary 26 rm 1800 26 rm 6923. In the system the daily rate of pay is divided by 8.

For normal working days an employee should be paid at a rate of 15 times their hourly rate for overtime work. 05 x ordinary rate of pay half-days pay ii. If they work more than 8 hours on public holiday you need to pay them at rate 30 x for the balance overtime working hours.

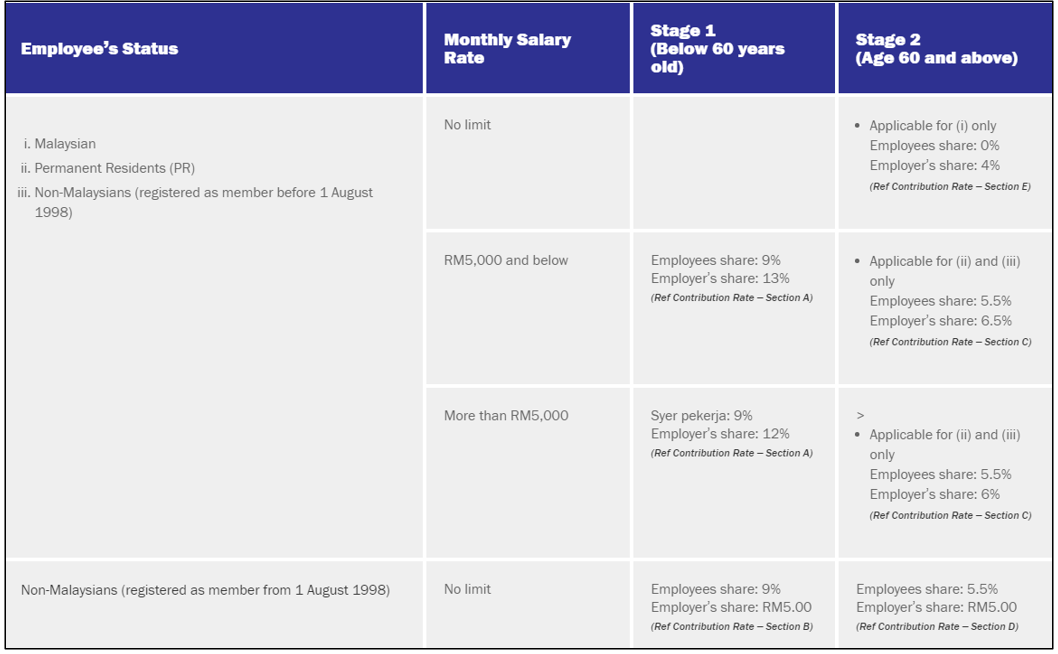

For employees who get paid on a monthly basis the hourly rate could be obtained by dividing the monthly salary by 25 or 26 days then divided by the amount of hours per normal working day. EPF Employer Contribution.

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Everything You Need To Know About Running Payroll In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

Easy Steps On Calculating Your Overtime Pay Free Downloadable Sheet Career Resources

Overtime Calculator For Payroll Malaysia Smart Touch Technology

How To Calculate Public Holiday Pay In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime For Salary Employees In Malaysia Madalynngwf

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Calculate Overtime In Excel Google Sheets Automate Excel

Jasmeen Is Working At Regal Haven Sdn Bhd With A Monthly Basic Course Hero

Guide To Calculating Overtime Pay For Employees In Malaysia Links International

Guide Singapore Overtime Pay Rules And Overtime Pay Calculator