Login to the PayrollPanda app go to Yearly Forms Select Form E Download the CP8D txt file and form E pdf file. Dont be part of this statistic for the new year.

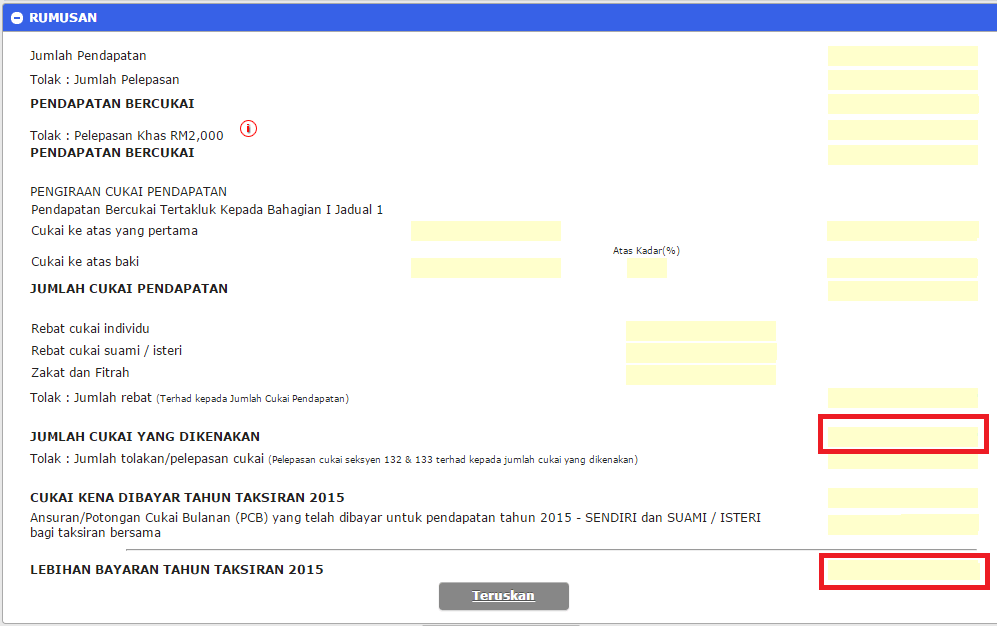

How To Step By Step Income Tax E Filing Guide Imoney

Income Tax what is it.

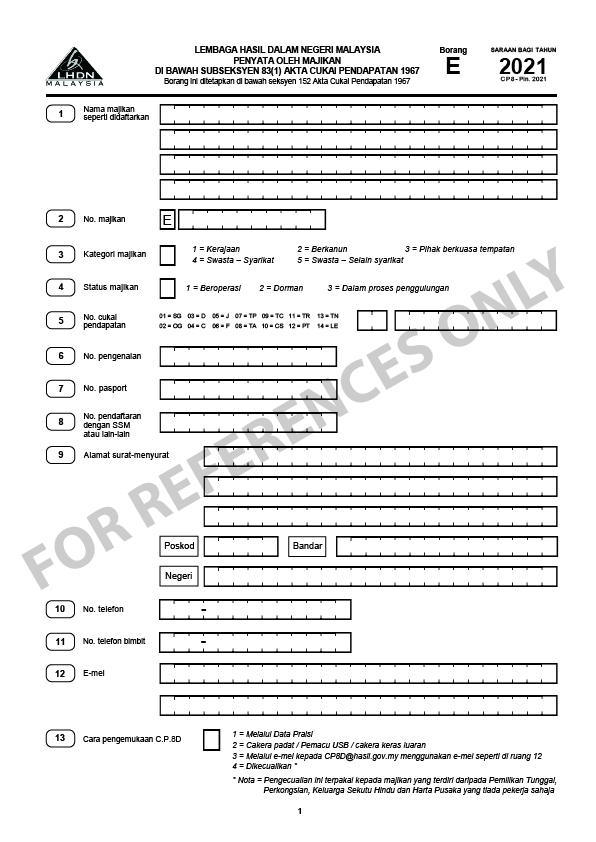

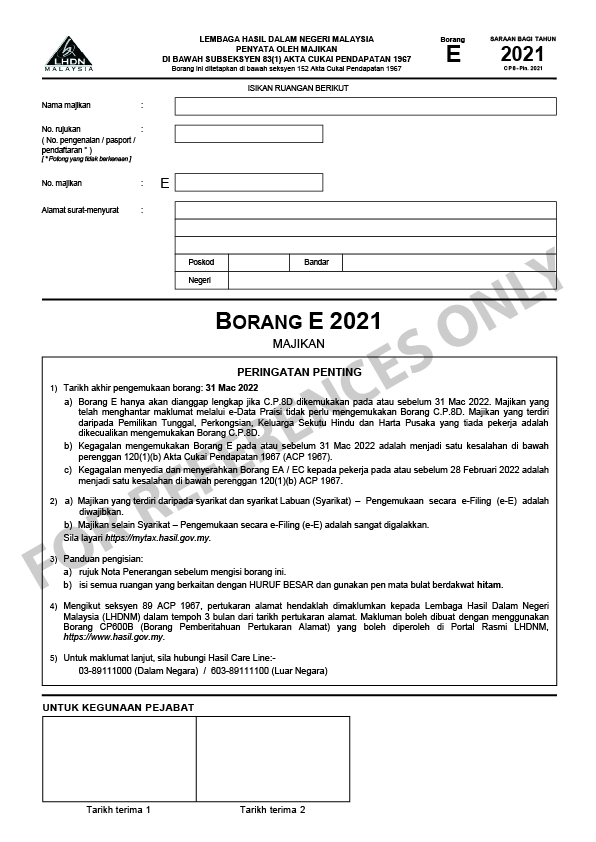

. 1 Due date to furnish this form. 2 Major information employers must provide in a Form E. 2016 E REMUNERATION FOR THE YEAR RETURN FORM OF EMPLOYER 1 Name of Employer as Registered Employers No.

Form E will only be considered complete if CP8D is submitted before or on the due date for submission. Partnership Sole Proprietorship. Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A.

Form E Borang E is a form required to be filled and submitted to Inland Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN by an employer. 6018-970 9800 607-859 0410 607-859 0410. The main conditions for admission to the.

Headquarters of Inland Revenue Board Of Malaysia. Essentially its a form of declaration report to inform the IRB LHDN on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year. E 2021 Explanatory Notes and EA EC Guide Notes.

Queries Issued on Documents and Applications Lodged with t he Registrar. Companies Act 2016. Form E to be indicated in Box 13.

Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016. English Version CP8D CP8D-Pin2021 Format. 2016 version of Forms EA EC and CP 8D employer related With regards to the amendments of Form CP8D and Form EA EC the improvements are made for the purposes.

CP207 Remittance Slip for Form C. Filing program for 2017 tax returns. Passport No7 Registration No.

81800 Ulu Tiram Johor Malaysia. 2 E 3 Status of Employer 1 Government 2 Statutory 3 Private Sector Income Tax No. Employers who have e-Data Praisi need not complete and furnish CP8D.

EA Form in PDF Download. 47 47A. 8 with CCM or Others Date received 1 Date received 2 Date received 3.

As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Section 83 1A Income Tax Act 1967. 31 March 20 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2020.

EC for public sector employees. Form E to be indicated in Box 13. Paper Form E if submitted by a Company is NOT DEEM RECEIVED for the purpose of subsection 831B of ITA 1967.

Employers can start preparing for Form E now. INDONESIA LAOS MALAYSIA MYANMAR PHILIPPINES SINGAPORE THAILAND VIETNAM 2. BORANG E PENGEMUKAAN OLEH MAJIKAN SELAIN SYARIKAT FORM E - SUBMISSION BY EMPLOYERS OTHER THAN COMPANIES.

The deadline for submitting Form E is 31032022. Starting from 2016 all Malaysian companies Sdn Bhd will need to declare a Form E to LHDN regardless there are employees or not. Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read.

A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees. EA Form in Excel Download. Employers may still submit Form E manually to IRB this year for Year of Assessment 2015 submission.

Mandatory Submission of Form E via E-Filing for Employers which are Companies The Inland Revenue Board of Malaysia IRBM has announced that all employers which are companies including Labuan companies are mandatory to submit Return Form of an Employer Form E via e-Filing for the Year of Remuneration 2016 and onwards in accordance with. INDONESIA LAOS MALAYSIA MYANMAR PHILIPPINES SINGAPORE THAILAND VIETNAM 2. This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved.

However employers are mandatory to furnish Form E online via E-filing effective Year of Assessment 2016 which is due for submission in Year 2017. The main conditions for admission to the preferential treatment under the ACFTA Preferential Tariff are that products. E 2016 Explanatory Notes and EA.

All companies Sdn Bhd must submit online for 2018 Form E and. 2016 E REMUNERATION FOR THE YEAR RETURN FORM OF EMPLOYER 1 Name of Employer as Registered Employers No. Companies Act 2016.

Borang E 2021 PDF Reference Only. Form 4 02 OG Identification. PDF uploaded 1102018 5.

Therefore LHDNM will no longer issue paper Form E to Companies commencing from the Year of Remuneration 2016. Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. 65392 employers were fined andor imprisoned for not submitting BorangForm E in the Year of Assessment 2014.

Amendments To Form E CP8D EA EC in Respect of Remuneration for The Year 2016. In cases where invoices are issued by a third country the Third Party. In addition every employer shall for each calendar year prepare and render to his employee a statement of remuneration EA for private sector employees.

According to the law taxpayers must submit and commit. B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Any dormant or company not in operation are also required to submit Form E Borang E as well.

As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. Please be reminded to check the forms as it is the employers responsibility to provide accurate information to the statutory bodies. The main conditions for admission to the.

Generate Form E and CP8D txt file via the PayrollPanda app. INFORMATION ON NUMBER OF EMPLOYEES FOR THE YEAR ENDED 31 DECEMBER 2016 A1 NUMBER OF EMPLOYEES Total number of employees in the employers company business as at 31 December 2016. Form E 161210_Form E colour 121610 1220 PM Page 1.

This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved. Email confirmation from LHDN. Starting from 2016 onwards all company is made mandatory to submit Form E Borang E regardless whether they have employees or do not have any employees.

All partnership and sole proprietorship are mandatory to submit Form E. Download Form - Employer. Download the latest Form E here.

Income Tax is a type of tax which government impose on income earned by personal or business such as monthly salary and business income. PDF uploaded 1772019. A2 NUMBER OF EMPLOYEES SUBJECT TO MTD.

LHDN Malaysia announced the new Form E format for 2021 income tax declaration on 412022. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Parties which accept this form for the purpose of preferential treatment under the ASEAN-CHINA Free Trade Area Preferential Tariff.

The IRB has recently updated the following.

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

7 Tips To File Malaysian Income Tax For Beginners

Review 2016 Isuzu D Max Z Prestige 3 0l Form Over Function

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

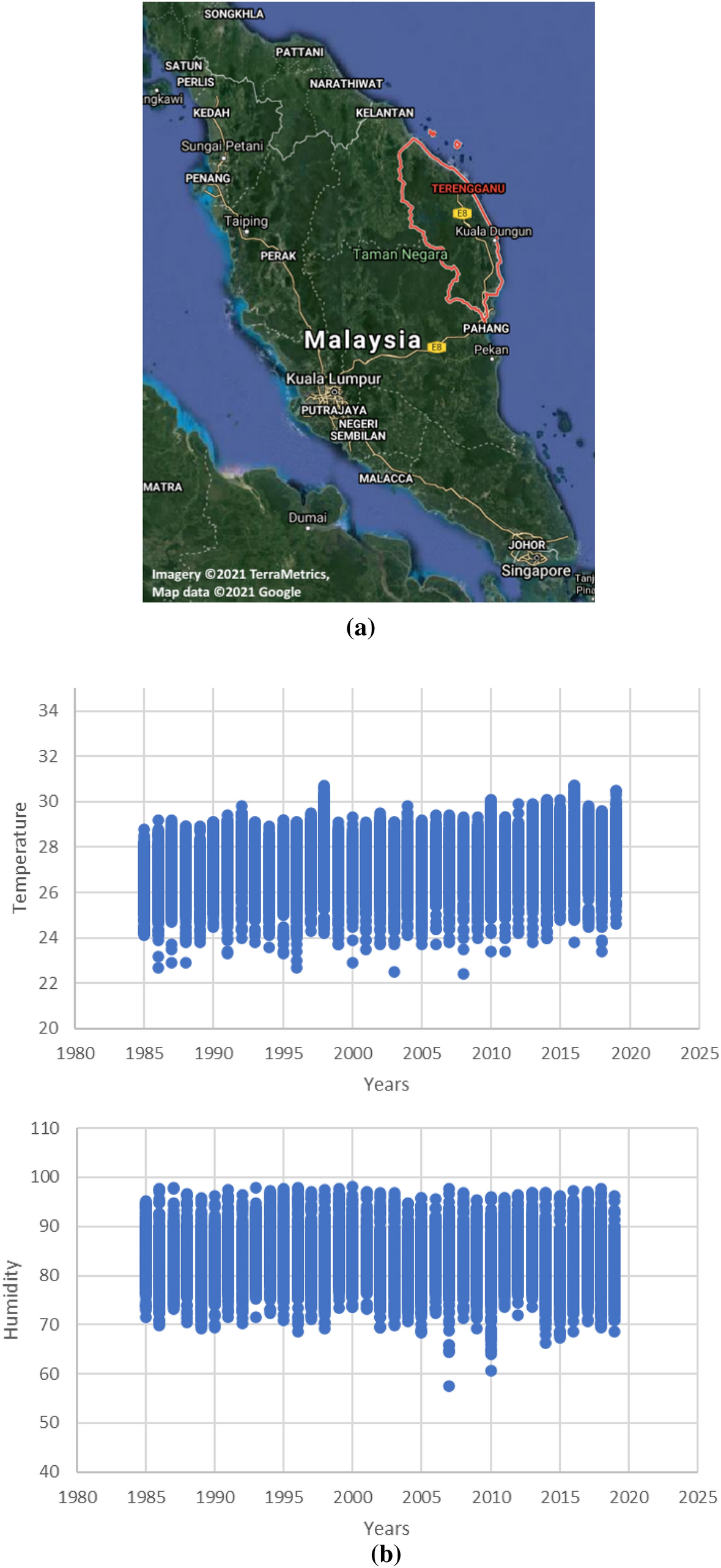

Developing Machine Learning Algorithms For Meteorological Temperature And Humidity Forecasting At Terengganu State In Malaysia Scientific Reports

How To Step By Step Income Tax E Filing Guide Imoney

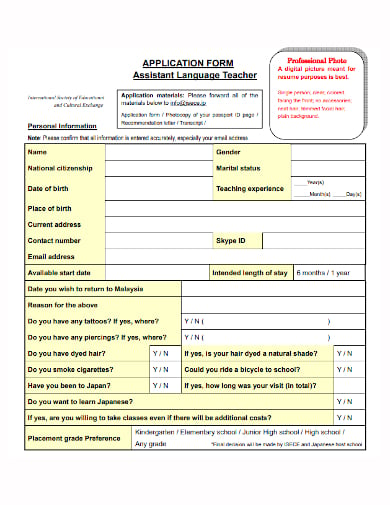

Application Form Template 20 Free Word Pdf Documents Download Free Premium Templates

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Resumes Mindsparkle Mag Graphic Design Resume Resume Design Graphic Resume